Now that you’ve determined you are eligible for the Solar Incentive Tax Credit (ITC), you are most likely wondering where to start to claim your credit. First off, you will need to complete the IRS Form 5695, “Residential Energy Credits” in order to claim your credit. Then, you will need to add your renewable energy credit information to your 1040 form. Below is a helpful walk through of how to complete the 5695 Form and claim your Solar ITC.

.

Please keep in mind, Dividend Finance does not offer tax advice. Please consult with your tax advisor if you have any tax-related questions.

Completing Form 5695

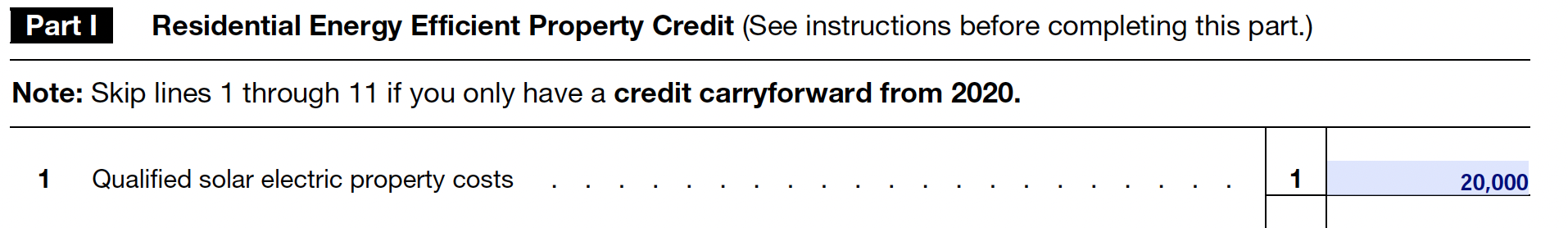

1. First off, you will need to know the total cost of your solar energy installation. Insert the total cost in line 1. For this example, we will say the total energy installation is $20,000.

2. Then, if you had additional energy improvements, you will enter these costs on line 2 through 4 and total them on line 5. For this example, we will say there were no additional energy improvements.

3. Now, on line 6, multiply line 5 by 26% or .26 to determine the amount of the solar tax credit. For this example, the total amount of the solar tax credit will be $5,200.

4. If you are not receiving a tax credit for fuel cells and aren’t carrying forward any credits from the previous year, put the value from line 6 on line 13. In this example, we will assume neither of these apply.

5. Now, you will need to figure out if you have enough liability to receive the full credit in the year you are filing for. Navigate to page 4 of the 5695 Form Instructions to determine the limit on tax credits you can claim. On the first line of the “Residential Energy Efficient Property Credit Limit Worksheet” section enter your total federal tax liability. You can find this number on line 47 of your Form 1040. For this example, we will assume a $5,200 tax liability.

6. For line 2 add in any additional tax credits you are claiming for adoption expenses. For this example, we will not claim any adoption expenses.

7. On line 3, subtract line 2 from line 1. As well, enter this amount on line 14 of Form 5695.

8. Moving back to Form 5695, enter this number on line 14. On line 15, enter which the smaller of line 13 and line 14 on your Form 5695. For this example, that would be $5,200.

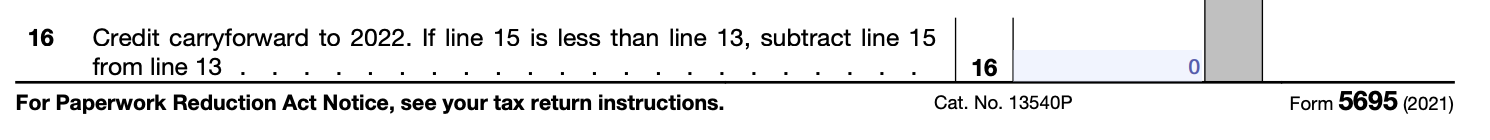

9. On line 16, subtract line 15 from line 13 to determine how much of your tax credit you will carry over to next year. For this example, it will be $0.

10. Next, we will need to add this credit to the Form 1040 Schedule 3. The number on line 15 of your Form 5695 is the amount that will be credited on your taxes for that year. Enter this value on line 5 of Form 1040 or line 50 if you are using the Form 1040NR.

And that’s it! Now you can take advantage of your Solar Incentive Tax Credit and use it towards paying down your Dividend Finance loan to keep your monthly payments low and minimize the amount of interest paid over the life of your loan.

Once you have received your credit for the ITC, you can make your payment at anytime by visiting the Dividend payment portal here.

For more information please view the official instructions to complete Form 5695 here.

Please remember, Dividend Finance does not offer tax advice. Please consult with your tax advisor if you have any tax-related questions.